Donald Trump is close to becoming the 47th President of the United States. Right now, he has won 267 electoral college votes, just three short of the 270 needed to win the presidency officially. Trump also has around 51.1% of the popular vote, giving him a strong lead.

Many people are talking about what Trump’s possible win means, especially in areas like cryptocurrency. Trump’s views on rules for the economy, global relationships, and regulations are known to influence many areas, including how cryptocurrencies, like Bitcoin, will do in the market.

In past U.S. elections, Bitcoin prices have often risen after the election results are announced, and a new president takes office. For instance, after the last few elections, Bitcoin’s price has typically increased, making some wonder if the same will happen if Trump wins this election.

Will Donald Trump Change the Rules for Cryptocurrency?

Cryptocurrency is a type of digital money that many people are interested in, and some see it as the money of the future. But there are still lots of questions about how to regulate it. Regulation means setting rules and guidelines for how people and companies can use, trade, and create cryptocurrencies.

At first, Donald Trump wasn’t very supportive of cryptocurrency. In fact, he was pretty skeptical and even doubted its future. However, recently, his views seem to have changed. Trump is now a big supporter of cryptocurrency and wants the United States to lead the world in the crypto space. He believes that the U.S. could become the top place for developing and using cryptocurrencies.

Trump has also spoken against the idea of a “central bank digital currency,” often shortened to CBDC. A CBDC is a digital version of money that is issued by a country’s central bank. While some countries like China are working on creating their own digital currency through their central bank, Trump is not very interested in the U.S. doing the same.

Since Trump’s last term as president, there have been new rules introduced for crypto. For example, there are now rules for crypto exchanges, which are platforms where people buy and sell cryptocurrencies, and for stablecoins. Stablecoins are a type of cryptocurrency that aims to keep a stable value, often tied to regular currencies like the U.S. dollar.

If Trump becomes president, his opinion on exchanges like Coinbase and Binance, two popular places where people trade crypto, could lead to changes. This could impact how these platforms operate in the U.S. Some think Trump might change or even remove some regulations, making it easier for these platforms to operate.

Donald Trump’s Opinion on the U.S. Digital Currency

One of Trump’s strongest views is his dislike of a digital U.S. currency. Trump has been very clear that he is not a fan of the U.S. government creating a digital dollar, like what China is doing. If Trump slows down the U.S.’s work on a digital currency, it might make the country’s approach to cryptocurrency different from other nations, especially China, which is moving forward quickly with its digital currency project.

Trump’s Economic Policies and the Impact on Crypto Prices

Trump is known for his economic policies that focus on tax cuts and government spending. He has a history of cutting taxes to try to stimulate or boost the economy. However, these actions can sometimes lead to inflation. Inflation is when the price of goods and services goes up, which means the purchasing power of money decreases. When inflation is high, people often look for other ways to keep their money safe from losing value.

One option some people choose is Bitcoin. Many investors see Bitcoin as a “safe haven,” meaning a place to keep their money safe, similar to how people use gold during uncertain times. So, if inflation goes up under Trump’s policies, more people might turn to Bitcoin, which could increase the demand for it and possibly drive up its price.

Trump could also influence how the Federal Reserve, which is the U.S. central bank, sets interest rates. Lower interest rates make it easier to borrow money, which can encourage spending and investment. If Trump pushes the Federal Reserve to keep rates low, it could lead to more investment in cryptocurrencies, making them more popular.

In addition, Trump sees the blockchain industry as a way to boost the U.S. economy. Blockchain is the technology that powers most cryptocurrencies, including Bitcoin. It is a system that records information in a secure and decentralized way. Trump’s last administration encouraged tech development, and if he does the same for blockchain technology, it could help the U.S. become a global leader in this area.

Polymarket Predictions & Crypto Donations in the 2024 Election

Polymarket is a platform where people can predict outcomes of events, including elections. According to Polymarket, Trump has a 99.4% chance of winning the election, while his competitor has a 0.5% chance. This prediction shows how much confidence people have in Trump winning.

Cryptocurrency enthusiasts are also getting involved in this election. Many people and companies in the crypto industry have donated large amounts of money to campaigns for seats in both the House of Representatives and the Senate. These donations aim to support candidates who are open to innovation and new technology, especially those who would support crypto-friendly regulations. In fact, crypto donations for the 2024 U.S. Presidential Election have exceeded $238 million, even surpassing traditional industries like oil and pharmaceuticals.

How Bitcoin Has Performed in Past U.S. Presidential Elections

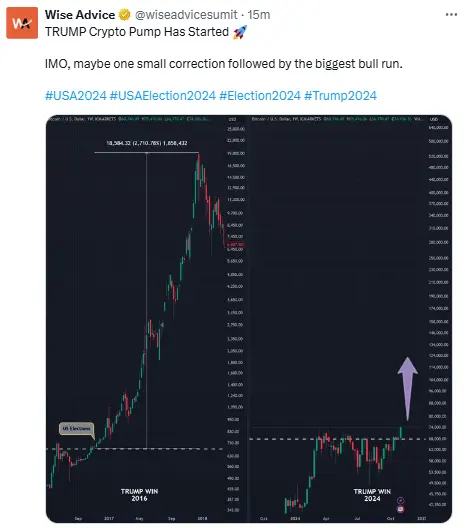

Looking at how Bitcoin has performed after past presidential elections can give us an idea of what might happen next. During the U.S. election in 2016, Bitcoin was trading around $700 per coin. By the end of 2017, its price had surged to nearly $20,000. Then, in the 2020 election, Bitcoin’s price was around $15,500 per coin in early November. By November 2021, Bitcoin’s price reached nearly $69,000.

These major increases in Bitcoin’s value show that U.S. elections can influence the cryptocurrency market, possibly because people feel more uncertain about the future during these times and look for alternative investments like Bitcoin.

In recent days, Bitcoin made an all-time high of $75,400 and is now trading around $73,000. The total market cap, which is the overall value of all cryptocurrencies combined, is now around $2.53 trillion. Bitcoin holds about 57% of the entire crypto market. Some experts believe that if Bitcoin keeps its current trend and Trump wins, the momentum could push Bitcoin’s price even closer to $100,000.

Final Thoughts

If Trump wins the presidency, he may continue to favor fewer regulations, which could benefit the crypto industry. Trump has a history of focusing on economic growth, and many expect that his policies could encourage more investment in cryptocurrencies. However, the crypto world has changed a lot since Trump’s last term. There are now more regulations and new rules that weren’t there before. Trump’s decisions could have a big impact on whether these rules stay, change, or even become stricter.

In past elections, Bitcoin prices have reacted strongly to big news about the economy. While some experts say that we could see more ups and downs in the crypto market in the next few days, many believe that a Trump win and possibly lower interest rates could be good for Bitcoin and other cryptocurrencies.

However, the market may need some time to fully adjust to these changes. Some experts warn that we could see a short-term drop in prices as people react to the news and the market settles down. Overall, Trump’s approach to economic policies, his views on regulation, and the direction of interest rates could all be factors that affect the crypto market, especially Bitcoin, over the next few years.