Today, the price of Bitcoin, the biggest cryptocurrency, suddenly shot up and reached almost $68,000 during the opening of the US market. However, this rise didn’t last long. After a few moments, Bitcoin’s value dropped again, and all the gains were lost. Let’s break down what happened, how it affected traders, and what experts think may happen next.

Bitcoin’s Quick Rise and Fall

At one point today, Bitcoin hit a high of $67,950 but is now trading just below $67,000. The sudden rise caught many traders off guard—especially those who were betting that the price would fall.

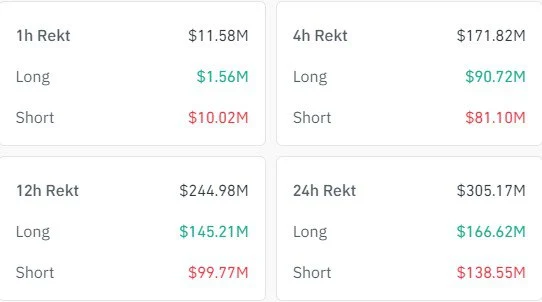

When Bitcoin’s price moves quickly, traders who made the wrong bets can lose a lot of money. Today, $138.55 million worth of these “short trades” were liquidated. (Short trades are bets that the price will go down. If the price goes up instead, these traders lose.)

But that wasn’t the only surprise. After Bitcoin hit its high, the price quickly dropped, and this time, many people who bet that the price would go up (long trades) also lost money. In total, about $166 million in long trades were wiped out.

Altogether, this means that $305 million worth of trades were lost in the past 24 hours across all cryptocurrencies.

Ethereum Also Had a Rollercoaster Ride

Bitcoin wasn’t the only cryptocurrency affected today. Ethereum (ETH), the second-largest cryptocurrency, also saw its price spike. It climbed up to $2,688 earlier today but later dropped to around $2,600.

These quick changes in price show how unpredictable the crypto market can be. One moment everything looks great, and the next, things can turn around quickly.

Bitcoin and U.S. Elections: A History of Big Moves

Historically, Bitcoin’s price tends to increase before major U.S. elections. Let’s take a look at two recent examples:

- 2016 Election: Bitcoin’s price jumped from $600 to $1,200 in the three weeks before the election.

- 2020 Election: Bitcoin surged from $11,000 to $42,000 by January 2021, shortly after the election.

This pattern suggests that elections create uncertainty in the economy, and some investors see Bitcoin as a “safe place” to store their money during such times.

Bitcoin’s Recent Surge: A New Trend?

In the last 30 days, Bitcoin demand has been rising, reaching levels not seen since April 2024. This is a big change from the slow market seen during the second and third quarters of this year. Some experts believe that this recent increase could mark the end of a period where investors were slowly accumulating Bitcoin, preparing for a bigger move soon.

Experts say that if Bitcoin’s price closes above $69,000, it could signal the start of a new parabolic move (a steep price rise). Once that happens, Bitcoin could trade between $70,000 to $75,000. However, if Bitcoin’s price falls below $65,000, it may drop further to around $62,000 or even $60,000.

What Traders Are Watching Next

The key level to watch is $69,000. If Bitcoin’s price closes above this level, it could act as support, and the price might climb higher. But if the price struggles and stays below $65,000, traders may expect a drop to $62,000 or $60,000.

October: A Special Month for Bitcoin

October is usually a good month for Bitcoin. In fact, over the past five years, Bitcoin has consistently ended the month with higher prices. Many traders call it “Uptober” because it tends to be a month of gains.

However, this October has had a rocky start. Many top cryptocurrencies saw losses in the first week of the month, making traders nervous. Even though today’s Bitcoin pump wasn’t as big as usual, it has given some hope to investors.

Final Thoughts

The cryptocurrency market is always full of surprises, and today’s quick rise and fall in Bitcoin’s price is a reminder of how unpredictable things can be. Some traders lost money, but others see the recent activity as a sign that Bitcoin may be preparing for a bigger move soon.

If Bitcoin manages to stay above $69,000, we could see it trading between $70,000 to $75,000. But if the price drops below $65,000, there’s a chance it could fall even further.

For now, everyone is keeping a close eye on Bitcoin’s price movements, hoping that the rest of October will bring more positive news.