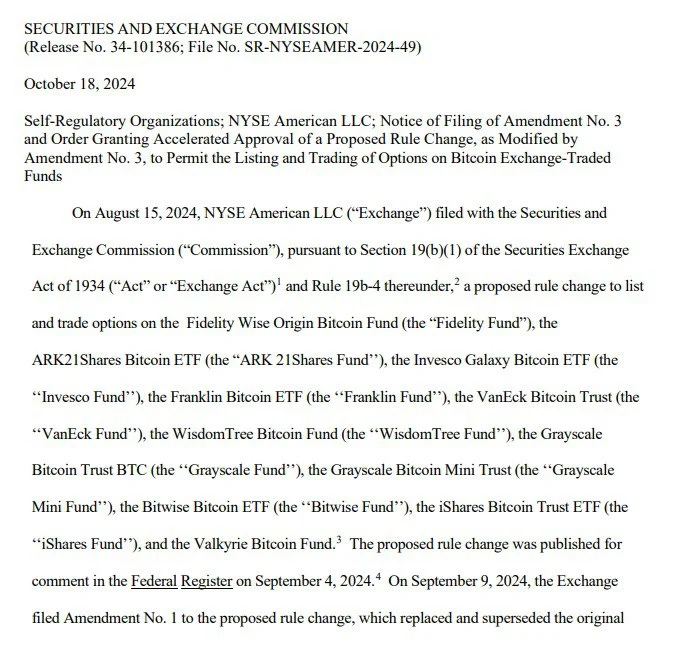

Last week, the U.S. Securities and Exchange Commission (SEC) made a big announcement that surprised the cryptocurrency market. They approved options trading for Bitcoin ETFs (exchange-traded funds). This approval is exciting for investors because it gives them more ways to invest in Bitcoin. It might also change how the Bitcoin market behaves in the future.

What Are Bitcoin ETFs and Options Trading?

Before we dive deeper, let’s break this down into simpler words.

- Bitcoin ETFs are investment products that let people invest in Bitcoin without buying Bitcoin directly. Instead, people buy shares of an ETF, which tracks Bitcoin’s price. Think of ETFs like a “basket” of investments that make it easy to buy and sell Bitcoin-linked shares, just like stocks.

- Options trading gives people the choice (but not the obligation) to buy or sell an asset (like a Bitcoin ETF) at a set price before a certain date. It’s like reserving a ticket for a concert. You can choose to go or not, depending on how things look closer to the event. This flexibility attracts investors who want to manage risks while still aiming to make profits.

Bitcoin ETF Options Are Coming Soon

With this new approval, two major U.S. stock exchanges – the New York Stock Exchange (NYSE) and the Chicago Board Options Exchange (CBOE) – will begin offering options for Bitcoin ETFs. Each exchange will handle different products:

- NYSE:

- Grayscale Bitcoin Trust (GBTC)

- Grayscale Mini Bitcoin Trust (BTC)

- Bitwise Bitcoin ETF (BITB)

- CBOE:

- Fidelity Wise Origin Bitcoin Fund (FBTC)

- ARK 21Shares Bitcoin ETF (ARKB)

This move follows the SEC’s earlier decision to allow options trading for BlackRock’s iShares Bitcoin Trust. It shows that the SEC is becoming more open to letting people trade products linked to Bitcoin, which could mean we’ll see even more similar opportunities in the future.

How Does Options Trading Affect the Market?

Options trading introduces a new way for people to invest in Bitcoin. It gives investors more control over their trades by allowing them to back out if market conditions aren’t good. This feature can encourage large institutions (like banks and hedge funds) to join the Bitcoin market.

When these big players invest, it can reduce the wild swings in Bitcoin prices. Analysts believe that this could make Bitcoin’s market more stable and more like the traditional stock market.

Additionally, options allow investors to protect themselves from big losses when Bitcoin prices fall. This ability to manage risk is known as hedging, and it’s very important for large companies that handle a lot of money.

Bitcoin ETFs Are Becoming Popular

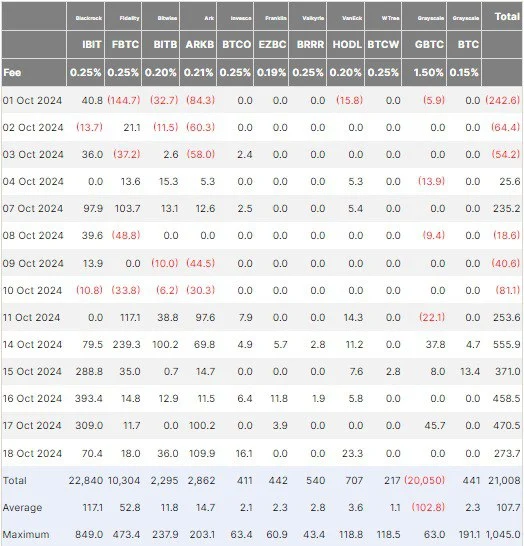

Bitcoin ETFs are growing fast, with more and more money flowing into them. Last week alone, Bitcoin ETFs reached $21 billion in net inflows (the amount of money coming into the funds). This shows that interest in Bitcoin is still very high. To compare, it took gold ETFs five years to reach this milestone, but Bitcoin ETFs hit it in just a few months!

On Friday, Bitcoin ETFs received about $273 million in new investments. Some of the top funds were:

- ARK Invest’s ARKB ETF: Over $110 million in new investments

- BlackRock’s IBIT ETF: Over $70 million in new investments

- Other big players, like Fidelity’s FBTC, VanEck’s HODL, and Bitwise’s BITB, also saw steady growth.

Even Grayscale’s Bitcoin Trust (GBTC), which usually has outflows (money leaving the fund), got $91 million in net inflows. This was a sign that investors are gaining more confidence in Bitcoin ETFs.

Bitcoin’s Value and Market Dominance Are Growing

Bitcoin’s price has been on the rise lately. It hit $69,000, very close to its all-time high. Along with this price increase, Bitcoin’s market dominance is also growing. Market dominance refers to how much of the total crypto market is made up of Bitcoin.

- Bitcoin’s dominance rose from 57.5% at the beginning of October to 58.5% now.

- When Bitcoin dominates the market like this, smaller cryptocurrencies (called altcoins) usually don’t perform well.

Right now, the global cryptocurrency market is valued at $2.44 trillion, with Bitcoin’s market cap making up $1.34 trillion of it.

Factors Driving Bitcoin’s Recent Growth

Several things are influencing Bitcoin’s price increase:

- Interest Rate Cuts in the U.S.: Lower interest rates encourage people to invest in assets like Bitcoin.

- Stimulus Packages in China: China’s economic support has boosted the entire crypto market.

- Cryptocurrency Donations to Donald Trump’s Campaign: News of Trump’s campaign receiving $7.5 million in crypto donations created excitement in the market.

- Launch of Bitcoin ETFs: The approval of more Bitcoin ETFs has also sparked enthusiasm among investors.

However, Bitcoin may soon face a pullback (a temporary drop in price). This could give altcoins a chance to bounce back if Bitcoin’s dominance decreases.

Will Bitcoin Keep Rising?

Bitcoin is now approaching a major resistance point at $69,000. If it breaks through this level and stays above it, Bitcoin could climb even higher, possibly trading between $70,000 and $75,000. But if trading volume doesn’t increase, Bitcoin’s price might fall back to $65,000 before trying to rise again.

To keep the upward trend going, Bitcoin needs strong support from investors. If it manages to turn $69,000 from resistance into support, we could see a parabolic move (a sudden, sharp increase in price).

Final Thoughts: What’s Next for Bitcoin and Crypto?

The approval of options trading for Bitcoin ETFs is a big step forward for the crypto market. It could attract more investors, including large financial institutions, which might help stabilize the market.

Retail investors (ordinary people) and institutional investors (like banks) are both showing strong interest in Bitcoin options. This combination could push Bitcoin’s price even higher or lead to new trends in the crypto world.

Some people expect Bitcoin’s price to keep rising, while others think altcoins might soon make a comeback. There’s also the possibility of a short-term pullback. Since opinions are divided, it’s important for investors to do their own research and be careful with their decisions.

In summary, Bitcoin’s market is evolving fast, and the introduction of options trading is opening new doors for investors. Whether prices rise or fall, one thing is certain: Bitcoin and crypto are here to stay, and they are becoming a bigger part of the financial world every day.