Hyperinflation is when the prices of goods and services rise at an incredibly fast pace. This means that the currency, or money, in a country loses its value very quickly. People can’t buy as much with the same amount of money as before. Imagine you could buy bread for $1, and then suddenly, in a few weeks, that same bread costs $5, then $10, then $20, and so on. This kind of situation can cause major problems in society, leading to economic chaos.

Countries like Venezuela and Argentina have been dealing with hyperinflation for many years. The government in these countries often tries to solve this by printing more money or by controlling the prices of things, but these solutions don’t work well. This is where cryptocurrency, like Bitcoin and stablecoins, could help. Cryptocurrencies don’t rely on any government or bank. Bitcoin, for example, has a limited supply, and stablecoins are tied to stable currencies like the U.S. dollar, making them less likely to lose value quickly. But the big question is, can cryptocurrency truly help countries dealing with hyperinflation?

Causes and Effects of Hyperinflation

Hyperinflation doesn’t just happen for no reason. It is often caused by several big problems, such as:

- Political Unrest: When a country is politically unstable or the government is not trusted, it can lead to hyperinflation. People lose faith in the currency and start to use other forms of money.

- Bad Economic Policies: Sometimes, governments make poor decisions about managing the economy, like printing too much money. When there is too much money in circulation, the value of the currency goes down, and prices rise fast.

- Money Printing: This is one of the main causes of hyperinflation. If a government prints a lot of money, its value decreases. It’s like if you add more water to soup, it will taste weaker. Similarly, adding more money makes each unit of currency worth less.

Hyperinflation can lead to terrible outcomes. People might not be able to afford basic needs like food, housing, or healthcare. In Venezuela, for example, the prices of food and other essentials are so high that many people struggle to survive on very low wages. The minimum wage, adjusted for inflation, was less than $10 per month by October 2024. In Argentina, the economy is in such bad shape that 40% of the population lives in poverty.

The Three Stages of Hyperinflation

Hyperinflation tends to happen in three main stages:

- First Wave: Inflationary Build-Up

This is the beginning stage where inflation is noticeable but not yet out of control. Prices start to rise as the government spends more and borrows money. Inflation is around 10–50% per year at this stage. At this point, it’s still possible for the government to take action and prevent things from getting worse. - Second Wave: Accelerating Inflation

Here, inflation starts to get much worse. The government, in a panic, prints even more money to try to fix the economy. But this only makes things worse. Inflation can exceed 50% per year. In this stage, people lose faith in the currency and may start using foreign money or other assets like gold to hold onto their wealth. Venezuela went through this stage between 2014 and 2017 when inflation shot up from 56% to over 2,600%. - Third Wave: Full-Blown Hyperinflation

In the final stage, prices can double every few weeks. In 2018, prices in Venezuela doubled every 26 days! People switch entirely to foreign currencies or hard assets because their local currency is worthless. In Zimbabwe, inflation in 2024 reached close to 600%.

How Hyperinflation Affects People and Society

When hyperinflation hits, people suffer immensely. In places like Venezuela and Zimbabwe, basic goods like food become too expensive for the average person to buy. Social problems, like high poverty rates and inequality, become worse because only a few people, who can buy foreign money or other assets, are protected. For most, their currency becomes so worthless that they can’t afford daily necessities.

In Argentina, for example, people are losing their savings because the local currency, the Argentine peso, keeps losing its value. The government tries to fix this by resetting the currency, but it hasn’t been successful in gaining the people’s trust back.

Can Cryptocurrencies Help?

In countries suffering from hyperinflation, cryptocurrencies are becoming popular as a possible solution. Here’s how some specific cryptocurrencies can help:

- Bitcoin

Bitcoin, unlike regular money, isn’t controlled by any government. Only 21 million bitcoins will ever be created, so it’s a limited resource. Many people in Argentina are now using Bitcoin because their local currency is so unstable. With Bitcoin, they don’t have to worry about the government printing more money and lowering its value. - Stablecoins

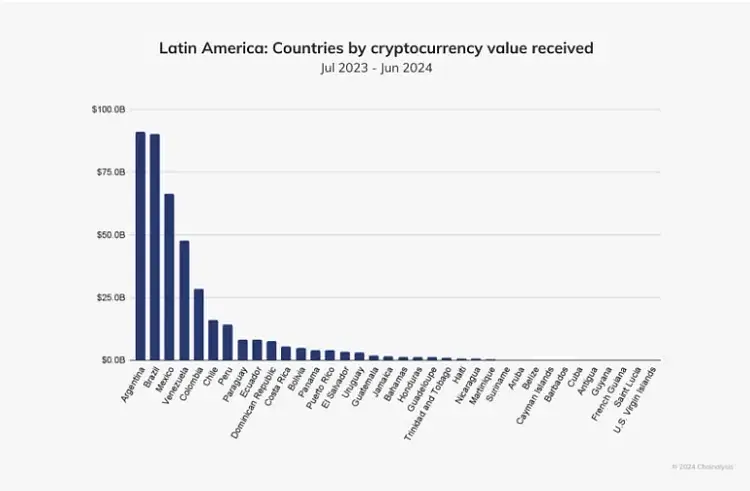

Stablecoins are digital currencies that are tied to stable currencies like the U.S. dollar. This makes them more predictable. In Argentina, about 62% of cryptocurrency transactions are in stablecoins, showing how much people want a secure place for their money.

Other Ways Cryptocurrencies Are Helping

In addition to protecting savings, cryptocurrencies are helping people send money across borders. For instance, many Venezuelans who live abroad send money back home to support their families. With traditional money transfer services, sending money can be expensive and slow. But with cryptocurrencies like Bitcoin or stablecoins, people can send money almost instantly and at a lower cost.

Examples of Cryptocurrency Use Around the World

Let’s take a look at some other countries where people are using cryptocurrencies as a way to deal with economic problems:

- Brazil

In Brazil, businesses are using stablecoins to help with cross-border payments. Brazilian companies prefer to use stablecoins because they’re less affected by the ups and downs of their local currency. - Nigeria

Nigeria is one of the biggest markets for cryptocurrency in Africa. People there use Bitcoin and other digital currencies to protect themselves from the devaluation of the Nigerian naira. Nigeria also has a large peer-to-peer (P2P) market for cryptocurrencies, where people trade directly with each other, avoiding high banking fees. - Zimbabwe

Zimbabwe, a country long affected by hyperinflation, also sees increasing use of cryptocurrencies. Even though the government has not fully embraced cryptocurrency, people are starting to understand its potential as an independent asset to protect against hyperinflation.

What Cryptocurrencies Offer in the Fight Against Hyperinflation

Cryptocurrencies are not controlled by any government or bank. They exist on decentralized networks called blockchains, where transactions are recorded and verified by many computers around the world. Because of this structure, it’s hard for governments to manipulate or control cryptocurrencies like Bitcoin or stablecoins.

Some of the benefits of cryptocurrencies include:

- Protection from Inflation: In countries with high inflation, people can keep their savings in cryptocurrencies to prevent them from losing value.

- Easy Access to Money: Cryptocurrencies can be used without needing a bank. This is important for people in countries where banks are unreliable or where they might not have access to a bank account.

- Faster and Cheaper Transfers: Sending money across borders is easier with cryptocurrency, saving people time and money.

Limitations and Conclusion

Cryptocurrencies are not perfect. Bitcoin can be very volatile, which means its value can go up and down quickly. Also, using cryptocurrencies requires access to the internet and some technical knowledge. Some governments are also wary of cryptocurrencies because they cannot control them.

In the end, while cryptocurrencies offer a way to help people protect their savings, they are not a full solution to the problem of hyperinflation. Countries need to fix their economies through better government policies. Cryptocurrencies are simply one tool among many that people can use to survive difficult economic times. For the future, the combination of good government practices and the use of new technologies like cryptocurrency might help create a more stable economic world.