In October 2024, inflation was a big topic in the news. Inflation means prices are going up, making things like food, fuel, and other everyday items cost more. This affects how much money people need to buy what they need. Let’s break it all down in simple words so everyone can understand.

Inflation in the United States

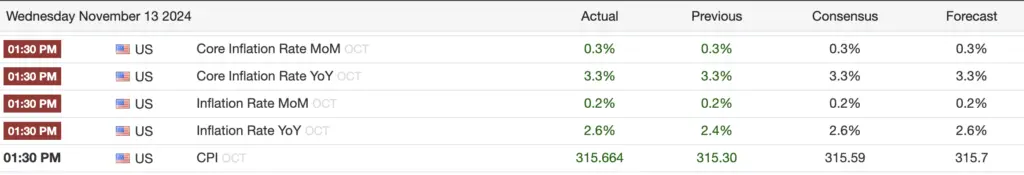

In the United States, the Consumer Price Index (CPI) shows how much prices for goods and services have changed over time. In October, inflation in the US rose to 2.6%, which was expected. This means things are 2.6% more expensive than they were at the same time last year.

- What does this mean?

If something cost $1 last year, it now costs $1.026. This might not seem like much, but it adds up over time, especially for families buying many items. - Why is it important?

Inflation affects everyone. When prices go up, people can buy less with the same amount of money. It’s harder to save, and it can change how much people spend.

The Effect on Cryptocurrency

Cryptocurrency is digital money like Bitcoin. Many people watch the price of Bitcoin and other cryptocurrencies because they think of it as an investment. Right now:

- The total value of all cryptocurrencies is $3 trillion, which is the highest since 2021.

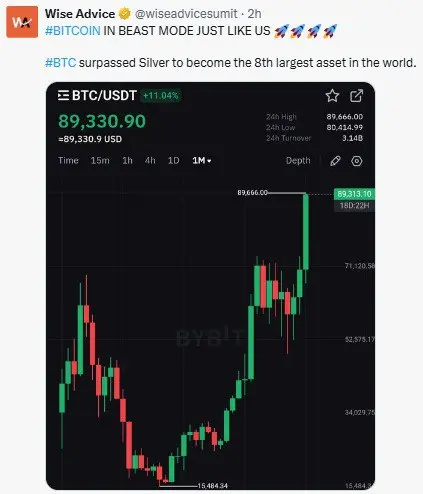

- Bitcoin’s price recently dropped a little but is still close to its record high. It reached $90,000 at one point but now trades around $89,000.

Inflation in India

India also faced higher inflation in October. Prices there increased by 6.2%, which is much more than in the US. This was the highest inflation rate in 14 months.

- Why did this happen?

The main reason was food prices. Essential items like vegetables, fruits, and oils became much more expensive. For example:- Food prices jumped by 10.87% in October.

- Core inflation, which ignores food and energy prices, also went up.

For people in India, this means their money buys less food and other necessities, making life harder.

What is the Federal Reserve Doing?

The Federal Reserve, often called “the Fed,” is like the US government’s bank. It makes decisions about interest rates, which can affect inflation.

- Interest rates and inflation:

If inflation gets too high, the Fed raises interest rates to slow it down. But in September and November, the Fed lowered interest rates instead. - Why lower rates?

Lower rates can make it cheaper to borrow money, which can help businesses grow and encourage people to spend. This can also increase the price of investments like cryptocurrency.

How Does This Affect Bitcoin?

Bitcoin is the biggest cryptocurrency. It’s like a digital version of gold for many investors. When the Fed lowered interest rates, it helped Bitcoin’s price rise.

- Bitcoin’s record high:

Bitcoin hit a new high of almost $90,000 in November 2024.- Its total value, called the market cap, is now $1.74 trillion, making it one of the largest assets in the world.

- Why did Bitcoin’s price go up?

Many big companies and investors are buying Bitcoin. Also, special Bitcoin funds, called ETFs, have become popular. These make it easier for people to invest in Bitcoin without directly buying it.

Trump’s Impact on Bitcoin

Donald Trump recently won the US election. His policies are seen as good for Bitcoin. He created a new government department called DOGE (Department of Government Efficiency) with Elon Musk and Vivek Ramaswamy leading it.

- What is DOGE?

This department aims to save money and make the government work better. It’s part of Trump’s “Save America” campaign. - Why does this matter?

Investors think Trump’s policies could help the economy and cryptocurrency. This is one reason Bitcoin’s price has been rising.

What Could Happen Next?

Experts believe two things could happen soon:

- More rate cuts:

If the Fed lowers interest rates again, it could make cryptocurrency more attractive. This could push Bitcoin’s price even higher. - Bitcoin’s future price:

Some experts think Bitcoin could reach $100,000 by the end of 2024 if the current trends continue.

Final Thoughts

Inflation affects everyone, from families buying groceries to investors watching Bitcoin. While higher prices can be tough, there are opportunities too. Cryptocurrencies like Bitcoin are becoming more popular, and government decisions will play a big role in what happens next.

For now, everyone is keeping an eye on inflation, interest rates, and the rising value of Bitcoin. Will it hit $100,000? Time will tell!