On Thursday, November 7, the United States Federal Reserve, led by its Chairman Jerome Powell, decided to reduce interest rates by 0.25% (or 25 basis points). This means that the new interest rates are between 4.50% and 4.75%. This is only the second time since 2020 that interest rates have been cut. The reason for this is to help control inflation and keep the economy stable.

Why Did the Federal Reserve Lower Interest Rates?

Chairman Jerome Powell decided to lower the interest rates after reviewing the latest economic data. The data shows that the economy is still growing, but it is not growing as quickly as before. Powell said that the US economy is still strong and should continue to grow in the future. However, he emphasized that the Federal Reserve’s goal is to keep inflation at 2%. Inflation is when the prices of goods and services go up over time, making things more expensive. The goal is to control prices without causing a lot of people to lose their jobs. If unemployment rises, it can hurt the economy and make life harder for many people.

Other Countries’ Interest Rate Decisions

Just a few hours before the US made its decision, the Bank of England (BoE) also lowered its interest rates. They cut the rates by 0.25%, bringing their new rate to 4.75%. This was expected by many people who closely follow the economy. After the BoE’s announcement, the value of the British pound increased by 0.5%. The BoE also shared its expectations for inflation in the coming years. They predict that inflation will reach 2.75% by the middle of 2025 and then drop to 1.8% by 2027.

Market Reactions to the Interest Rate Cut

When the Federal Reserve cut interest rates, it caused different reactions in the market. For example, gold prices went down. At first, gold prices had reached a record high of $2,705 per ounce, but after the interest rate cut, they dropped to around $2,691 per ounce.

At the same time, the US stock market went up. Stock prices reached new highs. This was partly due to the news about former President Donald Trump being re-elected. The S&P 500, one of the major stock market indexes, increased by 0.7%. The Nasdaq 100, another major index, rose by 1.5%. However, the Dow Jones Industrial Average did not change much. All three indexes hit record highs for the second day in a row. Meanwhile, the value of the US dollar, measured by the dollar index (DXY), stayed around 104.50.

What Will Happen in the Future?

The Federal Reserve believes that interest rates might continue to go down over the next few years. They predict that by the end of this year, rates could decrease to about 4.25%. By 2026, interest rates might go as low as 2.75% to 3%. However, Powell stressed that every decision about changing interest rates will depend on how the economy is doing at that time. This means that people should not expect interest rates to go down steadily without any changes.

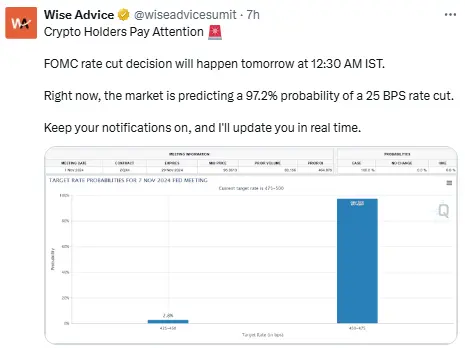

Most people who follow the market expected the interest rate cut to happen. About 97% believed there would be at least a 0.25% cut, while only 3% thought there might be a bigger cut of 0.50%. Overall, the market has been doing well this year because people expect lower interest rates and have seen signs that the job market is slowing down.

Positive Market Sentiments About Bitcoin

In addition to interest rates, there has been a lot of excitement about Bitcoin and the cryptocurrency market. There is talk about creating a Bitcoin Strategic Reserve in the United States, which has made people feel positive about Bitcoin’s future. This idea was supported by former President Donald Trump during his campaign. There is also speculation that if the head of the US Securities and Exchange Commission (SEC), Gary Gensler, leaves his position, Bitcoin’s price might go up to $100,000.

Analysis of Bitcoin and Other Cryptocurrencies

Bitcoin, the most well-known cryptocurrency, recently reached a record high price of $76,849. Currently, it is trading at around $75,899. If the price of Bitcoin drops below $69,000, it could fall further to $65,000 or even $62,000. On the other hand, if Bitcoin’s price goes above $76,292, it could increase further to between $80,500 and $90,000.

The total market value of all cryptocurrencies is currently $2.67 trillion. Bitcoin remains the most dominant, holding a market share of about 56.2%. After the news of Trump’s victory, other cryptocurrencies, also known as altcoins, saw their prices rise by 5% to 20%. Ethereum, the second-largest cryptocurrency, is trading close to $2,886.

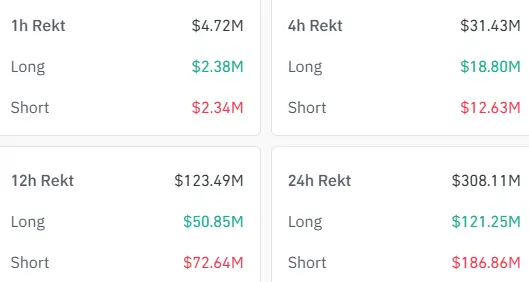

This increase in Bitcoin’s price has caused many traders to lose money due to sudden changes in the market. Over the past 24 hours, liquidations (when a trader’s position is automatically closed due to losses) totaled $308.11 million. Most of these were from short trades, amounting to $186.86 million. In total, 96,396 traders experienced losses due to market volatility.

Conclusion

The Federal Reserve’s recent interest rate cut is aimed at keeping inflation under control and making sure the economy remains stable. Market participants expect the Federal Reserve to continue adjusting interest rates based on how the economy performs in the future.

While markets have seen some changes, experts warn that more ups and downs could happen as people adjust to the new economic conditions. Despite this uncertainty, many analysts remain hopeful about Bitcoin and believe that clearer rules for cryptocurrencies might come during Trump’s presidency.