What Is Berachain?

Imagine a new kind of blockchain called Berachain. Berachain is like a big, powerful computer network built to help people trade, lend, and manage digital money. It’s also designed to make using DeFi (Decentralized Finance) apps easier and faster. DeFi apps are like online banking and finance apps but work with digital money without banks.

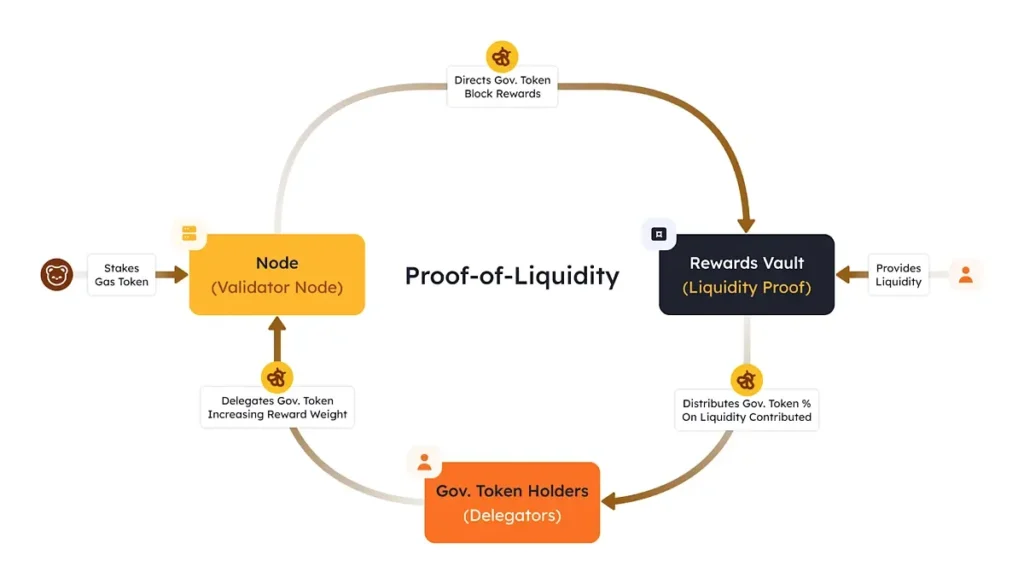

Berachain is special because it is built on something called Proof of Liquidity (PoL). Most blockchains use something called Proof of Stake (PoS), where people lock up their tokens (digital coins) to help keep the system secure. But Berachain uses PoL, which is different because it encourages people to keep their money available to use in DeFi apps rather than locking it away. This PoL system means that more people have the freedom to use their tokens and help the blockchain work well.

Key Takeaways

Here’s what makes Berachain special:

- It’s Built with a Fast Technology: Berachain is an “EVM-identical Layer 1” blockchain, meaning it works just like Ethereum (another popular blockchain) but is fast and doesn’t require extra steps for developers to start building on it.

- Proof of Liquidity (PoL): This is a new way to run the network that rewards people for making tokens available for trading and other activities, rather than locking them up. This makes DeFi apps easier to use.

- Different Tokens for Different Uses: Berachain has two main tokens: BERA (used to pay fees when you make transactions) and BGT (a special “governance token” that helps with voting and decision-making in the network).

- Cheaper and Faster Transactions: Berachain promises low transaction fees, meaning you can trade or do other activities without paying much. It also processes transactions quickly, so you don’t have to wait long.

- Still in Testing, Mainnet Coming Soon: Berachain is still in its test phase (where people can try it out without spending real money), and it’s aiming to launch fully by the end of 2024.

Why Does Berachain Use Proof of Liquidity?

In many popular blockchains like Ethereum, people have to “stake” or lock up their tokens to help secure the network. This method works well to keep the network safe, but it reduces the available tokens that people can use in DeFi apps. Berachain saw this as a problem because if people lock up too many tokens, it can make it harder to trade or lend tokens within the network.

Proof of Liquidity solves this issue by letting people use their tokens in DeFi apps even while they’re helping the network stay secure. So, on Berachain, you don’t have to choose between securing the network and using your tokens in DeFi. You can do both.

How Does Berachain Work?

Let’s break down how Berachain functions and what makes it different:

- Execution Layer: This is where all the action happens. Developers can easily bring their apps from Ethereum to Berachain without making changes. Since Berachain is “EVM-identical” (meaning it’s just like Ethereum), apps that work on Ethereum will work on Berachain too.

- Consensus Layer: This layer is what keeps the network safe and secure. The Proof of Liquidity (PoL) system in Berachain lets people keep tokens available while still helping the network. People who provide tokens to the network earn BGT, which gives them the ability to vote and make important decisions.

- Multi-Token System:

- BERA: This token is used to pay for transactions, like gas fees in Ethereum.

- BGT: This is a special token given to people who provide liquidity to the network. It’s “soulbound,” meaning it can’t be traded or transferred but allows users to vote on network decisions.

- HONEY: This is a stablecoin (a digital coin that is tied to the US dollar) used for trading within the Berachain network. You can use it in various DeFi apps like lending or trading on the platform.

The Berachain Team and Funding

Berachain began as a fun NFT project called BongBears in 2021. The team has raised $142 million to develop the network, with big investors like Polychain Capital, Samsung, and other major names in the industry. They aim to build a powerful, efficient blockchain that offers both security and easy access to DeFi services.

Berachain’s Unique Tokens

Here’s how Berachain’s tokens work:

- BERA: Used to pay for transactions, just like Ethereum’s gas fees.

- BGT: Given to people who provide liquidity (tokens) to the network. BGT holders get to vote on things like network changes or what assets should be accepted in the reward vault.

- HONEY: A stablecoin that’s always worth about one US dollar, making it easy to use for everyday trades or loans within the Berachain network.

Native DApps on Berachain

Berachain has created some of its own dApps (decentralized apps) to show what its network can do. Here are some examples:

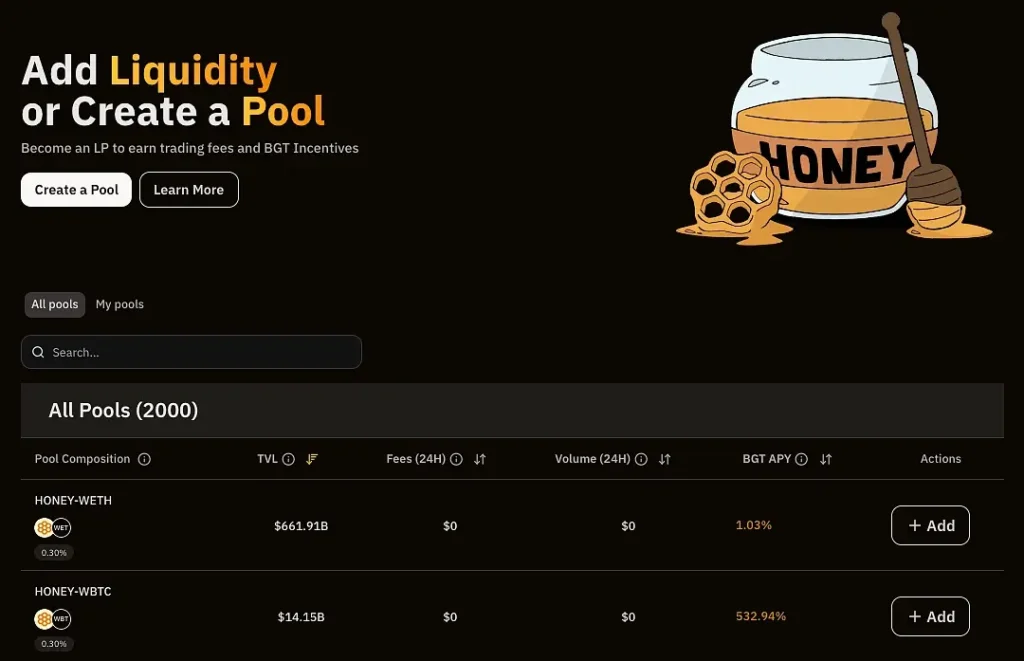

BEX (Decentralized Exchange): This is like an online exchange where people can trade tokens. It has special features that make transactions cheaper, and you can pay fees with the tokens you’re exchanging.

BEND (Lending Platform): BEND lets people borrow and lend tokens. Borrowers can earn BGT tokens, which makes it more appealing for users who need loans.

BERP (Perpetual Trading): This platform lets people trade using HONEY, and liquidity providers can deposit HONEY to earn BGT in exchange.

Final Thoughts

Berachain’s PoL system allows users to make tokens available for DeFi without locking them up completely, solving a big problem in DeFi today. It’s still in its test phase, but people are already trying it out, with the full network launching in late 2024.

Remember, before using or investing in any blockchain network, do your own research to understand the risks involved. This information is just for learning and should not be taken as financial advice.