Ethereum Whale Sells a Huge Amount of Ether

Recently, a very big investor, often called a “whale,” sold a large amount of Ethereum, which is worth around $47 million. This sale has worried many people who trade and invest in Ethereum because it may show that the whale is losing confidence in the cryptocurrency. Over the past two weeks, this same investor has been selling even more Ethereum coins.

The big investor, or whale, bought these Ethereum coins a long time ago, during a special event called the Ethereum Initial Coin Offering (ICO). Back then, they paid only $46,500 for the coins. Now, after all the recent selling by this investor, along with some other factors, the price of Ethereum has dropped by more than 10% in just one week.

Why People Are Worried About Ethereum

People are feeling uncertain about Ethereum for a few reasons. One reason is that the Ethereum Foundation, which is a big organization that supports Ethereum, is also selling off some of its Ethereum coins. When the foundation or big investors sell a lot of Ethereum, it usually means they think the price might go down, or they want to cash in on their profits. This can make smaller investors feel nervous and lead to even more selling.

Whales Are Selling Ethereum

Whales are investors who own a very large amount of Ethereum. When they decide to sell, it can create a big impact on the market price. Many of these whales bought their Ethereum when it was very cheap, so they may be selling now to make a big profit.

A recent example is one whale who sold around 19,000 Ethereum coins. This was worth more than $47.5 million! The whole transaction happened in just two days. This whale originally bought 150,000 Ethereum coins for only $46,500. Now, these coins are worth a huge $358 million because the value of Ethereum increased by 750,000%.

Selling on Cryptocurrency Exchanges

On September 27, the same whale moved around 12,010 Ethereum, worth more than $31.6 million, to an exchange called Kraken. When big investors move their coins to exchanges, it usually means they are planning to sell.

In the past, another whale sold 12,979 Ethereum coins for $34.3 million in September, after being inactive for four months. This whale originally took out 21,632 Ethereum from two exchanges, ShapeShift and Poloniex, back in 2016 when Ethereum was only $7 per coin. Since May 2024, this account has sold a total of 15,879 Ethereum coins, making around $43.5 million. They sold at an average price of $2,739 per Ethereum coin.

Ethereum Foundation Is Selling Ethereum Too

Another reason for the recent drop in Ethereum’s price is the Ethereum Foundation selling 35,000 Ethereum coins on August 23. The foundation sold their coins when the price was still high. After the sale, their balance dropped from 309,000 Ethereum to 274,000 Ethereum. In the past, whenever the Ethereum Foundation has sold a large amount of Ethereum, the price usually drops. This time, the price went down by almost 15% in just five days.

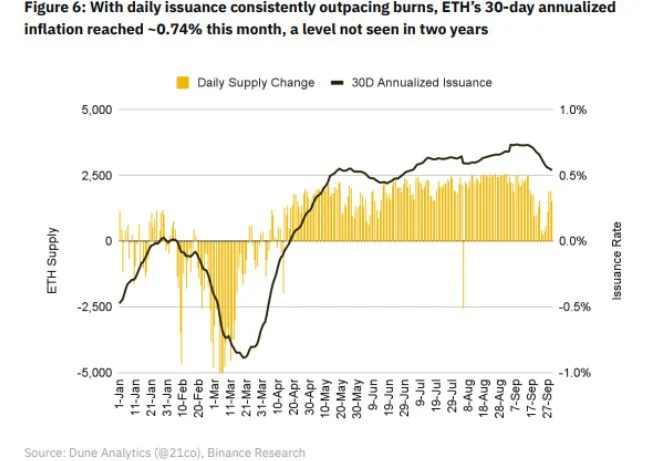

Ethereum’s Inflation Rate Is Going Up

According to Binance Research, the inflation rate of Ethereum is now the highest it has been in the last two years. This means more new Ethereum is being created compared to how much is being “burned” or destroyed. This is happening because fewer transactions are taking place on Ethereum’s main network.

Back in 2021, Ethereum introduced something called EIP 1559. This update burns a part of the transaction fees, which means it permanently removes some Ethereum from circulation. But now, fewer people are using the main network, so the amount of Ethereum being burned has gone down. Because of this, the inflation rate has gone up to 0.74%, which goes against Ethereum’s earlier plan to reduce the amount of Ethereum over time.

Some Positive News for Ethereum

Despite all the selling, there are some good signs for Ethereum. For example, on October 4, a lot of new money flowed into Ethereum ETFs (Exchange-Traded Funds). An ETF is a type of investment fund that holds assets like stocks or cryptocurrencies. On that day, around 2,695 Ethereum coins, worth about $6.43 million, were added to Ethereum ETFs. One big company, iShares, added $12.29 million worth of Ethereum, bringing their total holdings to 400,568 Ethereum coins, worth nearly $955.76 million.

This shows that some big investors are still interested in Ethereum, even if others are selling. At the same time, Bitcoin investment funds saw a decrease of around $77.38 million worth of Bitcoin being taken out. This suggests that some investors might be shifting their focus from Bitcoin to Ethereum.

Vitalik Buterin Suggests Changes for Ethereum

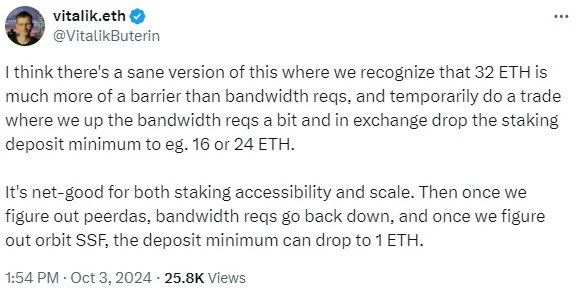

Vitalik Buterin, one of the founders of Ethereum, has proposed making some changes to help more people get involved in staking Ethereum. Staking is a process where people lock up their Ethereum coins to help run the network and earn rewards. Right now, people need 32 Ethereum coins to become a solo staker, which is over $74,000 at today’s prices. This is too expensive for many people.

Buterin suggested lowering the amount needed for staking to 16 or 24 Ethereum, which would make it easier for more people to join. In the future, he even thinks they could lower the requirement to just 1 Ethereum if a new technology called Orbit SSF is introduced. This could make the Ethereum network more decentralized and secure.

What Might Happen to Ethereum’s Price?

In March 2024, the price of Ethereum reached a local high of $4,050, which was its highest since January 2022. If Ethereum’s price falls, it could go down to $2,400 or even lower to $2,190. However, some experts think that Ethereum could go up a lot in the future. Some believe it could reach over $10,000 by 2025, especially if Bitcoin also goes up and crosses the important $65,000 mark.

Final Thoughts

Right now, there are mixed feelings about Ethereum. While some big investors are selling, others are still buying. For those interested in Ethereum, it is best to be careful because the prices could still go up or down a lot.

If an Ethereum spot ETF gets approved, this could be very good news for Ethereum. It would show that Ethereum, like Bitcoin, is valuable and recognized by big financial institutions and regulators.